President & CEO’s Message

"Recognising our substantial impact on the energy landscape and the pressing need to transport energy more sustainably, in 2023 we launched our new Energy Transition Strategy #deliveringProgress. This strategy aims to deliver more energy with less emissions to meet the world’s need for energy security and society’s demand for lower emissions."

Zahid Osman

President & CEO

Celebrating 30 Years of Progress and our People

Over the last 30 years, AET has demonstrated remarkable growth both as an owner and operator of maritime transportation assets and as a specialised maritime service provider. It is safe to say that we have come a long way from our humble beginnings with three vessels in 1994, to becoming a leader in the tanker and lightering industry.

Read More

AET at a Glance

Financial (US$)

Revenue

EBITDA**

Total Assets

Assets (as of 30 April 2024)

Average Age of Our Fleet vs 12.7 Industry Average

LNG dual-fuel Very Large Crude Carrier (VLCC) Newbuilds Delivered in 2023/2024

Dual-Fuel Assets

Aframax

2

DPST

2

VLCC

5

Newbuilds

4*

Vessels

World’s Only

Owner-Operator of MCVs

Operational Excellence

Vessel Availability & Vessel Utilisation

Ship-to-ship (STS) Transfers in US Gulf since Inception

Human Capital (Onshore)

Nationalities

Number of Staff

Male

Female

World's First Ammonia Dual-Fuel Aframaxes

Shipbuilding and long-term Time Charter Party (TCP) contracts signed in 2024

Awards and Recognition

vessels received Chamber of Shipping of America (CSA) Jones F. Devlin Award for Safety

vessels received CSA Annual Environmental Achievement Award

Health, Safety and Environment (HSE)

Total Scope 1^ Absolute Greenhouse Gas (GHG) Emissions Reduction in 2023 compared to 2008

Total Scope 1^ AERCO2e# Reduction in 2023 compared to 2008

Total Scope 1^ AERCO2e# Reduction in 2023 Year-on-Year (Y-o-Y)

Lost Time Injury Frequency (LTIF)

Total Recordable Case Frequency (TRCF)

Information correct as of 31 December 2023 unless otherwise stated

*Two owned ammonia dual-fuel Aframax newbuilds and two signed in-chartered newbuild contracts for LNG dual-fuel Aframaxes

** Earnings Before Interest, Taxes, Depreciation and Amortisation (EBITDA)

^ For detailed description on what Scope 1 entails, refer to “Towards Decarbonisation” section under the Environment Sustainability Pillar on page 64

# AERCO2e: Annual Efficiency Ratio Carbon Dioxide Equivalent

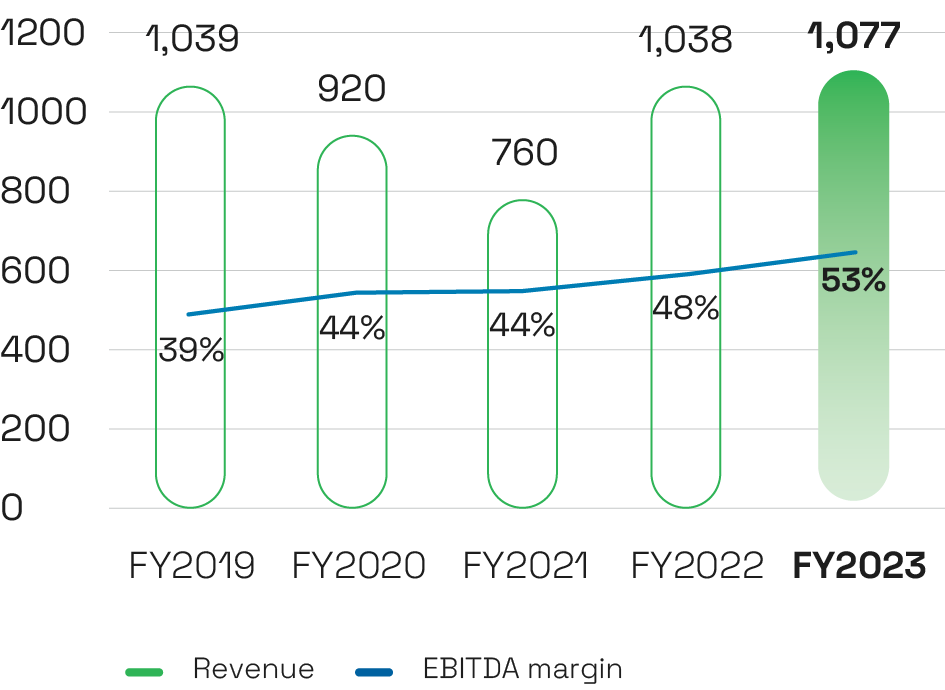

Our Financial Performance and Year in Review

Revenue (US$ M) and EBITDA Margin (%)

Net Debt to Equity

*The mean data includes AET and large tanker players we identified as our peers in the industry

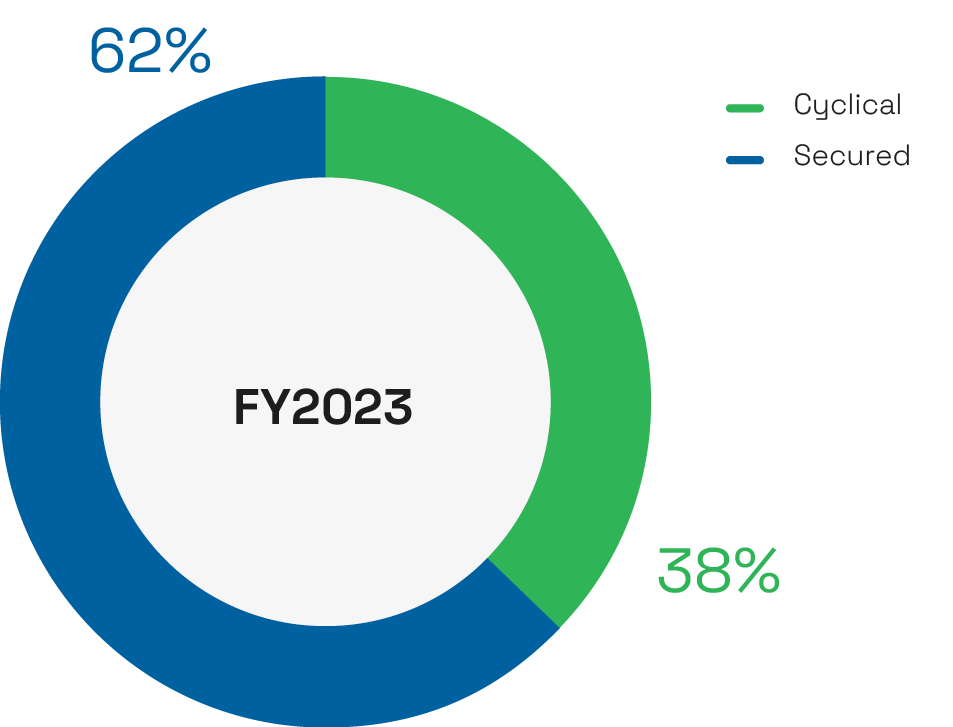

EBITDA by Income Type

FY2023 EBITDA Contribution

Climate-Related Financial Disclosures

Read MoreOur Performance Data & Sustainability Reporting Standards & Disclosures

Read MoreAET CONNECTS 2023/2024

View the report